The Daley Note: September 7, 2023

ONEOK (OKE) is joining a wider push by industry to expand NGL pipelines. On its 2Q23 earnings call, OKE announced plans to expand its Elk Creek Pipeline out of the Bakken and loop its West Texas NGL pipeline. East Daley Analytics previously reviewed the West Texas NGL expansion and found it compelling, based on our NGL Network Model. The Elk Creek project is a different story.

Management noted the Elk Creek expansion can be built at limited cost and expects it to be a “very high-return, low-multiple” project, consistent with a pump station expansion. The Tulsa-based company previously planned to expand Elk Creek in 2020, and at the time cited a cost of $305MM to add the 10 pump stations needed to reach 400 Mb/d of capacity.

Due to pandemic-related production declines, OKE reduced the scope of that project from 160 Mb/d to 60 Mb/d (bringing total Elk Creek capacity to 300 Mb/d). The more modest expansion cost ~$100MM. Using the old project estimate and the reported spend on the smaller expansion, EDA estimates the latest expansion could cost $205-225MM after accounting for inflation.

ONEOK did not provide a timeline for the Elk Creek expansion but claimed it would not let the Williston Basin fall short of capacity. However, EDA does not expect producers in the Bakken shale to hit NGL constraints, whether or not the expansion is built.

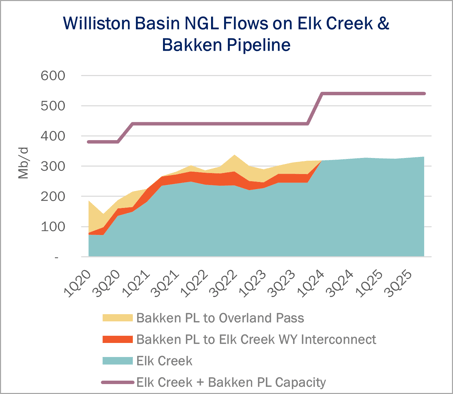

According to the latest Energy Information Administration data, the Williston hit 460 Mb/d of NGL production in May 2023, and East Daley expects output to stay flat going forward. Elk Creek and OKE’s Bakken Pipeline are the main pipeline options out of the basin, and both have available capacity (see figure).

According to EDA’s NGL Network Model, flows on the Bakken Pipeline have only averaged ~77 Mb/d, well below the system’s capacity of 140 Mb/d. The pipeline delivers ~43 Mb/d of those volumes to Overland Pass (OKE owns 50% with operator Williams (WMB)) and ~34 Mb/d to Elk Creek’s Wyoming interconnect for eventual delivery to Conway and Bushton, KS. Elk Creek has only averaged ~230 Mb/d from its Bakken interconnect in Montana, according to the NGL Network Model. The pipeline fills up the remainder of its 300 Mb/d of capacity with Bakken barrels that travel on the Bakken Pipeline and NGL production from the Powder River Basin (PRB).

It's possible that ONEOK only expanded the PRB-Kansas leg of Elk Creek when it reduced the scope of the 2020 project, which would mean there is only ~65 Mb/d of unutilized capacity between OKE’s two pipes. Alternatively, there could have been contracts on Bakken Pipeline and Overland Pass that limited the full utilization of the Bakken-PRB leg of Elk Creek. Either way, there is plenty of egress capacity on those pipes already. – Ajay Bakshani, CFA Tickers: OKE, WMB.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides bi-monthly updates on the US Crude Oil Market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)