Occidental (OXY) is reported to be exploring a possible sale of its stake in Western Midstream (WES). East Daley Analytics made the case previously for a tie-up with Enterprise Products (EPD), though several other midstream companies could see synergies from a WES acquisition.

Reuters reports that OXY has engaged JPMorgan Chase to manage the process for a potential sale totaling ~$20B in debt and equity. OXY owns 49% of Western Midstream and is the general partner; Occidental acquired the WES interests as part of its acquisition of Anadarko Petroleum in 2019. Management at WES denies any involvement in a deal. In a press release, WES said it has not engaged with bankers or advisors as part of a potential sale, and referred all inquiries to OXY.

Separately, Western Midstream sold its equity interests in five non-core assets for total proceeds of $790MM. The assets sold include WES’ interests in the Marcellus gathering system, Saddlehorn Pipeline, Whitethorn Pipeline, Panola Pipeline, and Enterprise Fractionators 7 & 8. Notably, EPD was the buyer of three of the assets.

In the 2024 Dirty Little Secrets EDA’s Dirty Little Secrets, East Daley reviewed the mergers and acquisitions (M&A) landscape and identified several midstream companies as ripe for takeovers. One of the companies we identified, NuStar (NS), has already been acquired. Western Midstream was another company we profiled.

What makes Western an attractive candidate for M&A? WES owns several attractive midstream assets, including gathering systems for natural gas, oil and produced water in the heart of the Permian Basin. But WES lacks the integrated value chains required to compete with top midstream companies, making a sale more likely to unlock value.

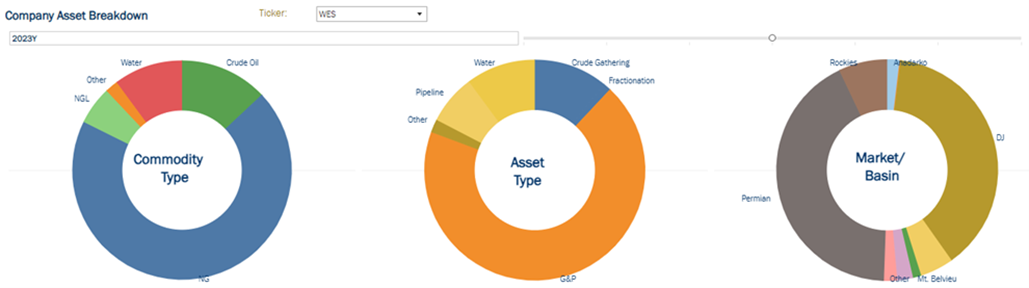

East Daley subscribers can analyze WES and its asset portfolio in the “Company Comparison Report” dashboard, available in Energy Data Studio (see figure from dashboard). WES owns a diverse midstream portfolio spanning commodities and basins. The company’s largest assets include its Denver-Julesburg G&P system and its crude oil/gas/water gathering systems in the Delaware Basin.

In the latest Dirty Little Secrets, we looked at potential tie-ups for WES based on combinations with asset overlap, volume/export growth potential, and/or asset diversification. Based on these factors, we profiled Enterprise as a possible suitor.

EPD's acquisition of the interests in Whitehorn (Midland-to-ECHO 1), MB Fracs 7 & 8, and Panola already consolidate some of the jointly owned assets, but there is still more on the table from a WES combo, such as Front Range and TX Express. Also, WES' NGL production at its Permian plants could add significant volumes to EPD's NGL pipeline and export expansions. WES currently sends its Permian NGL production to DCP’s Sand Hills and ET’s Lone Star Pipeline.

Energy Transfer (ET) would be another suitor that could leverage WES' G&P positions to drive commercial synergies with its downstream NGL business. Phillips 66 (PSX) and its DCP assets would integrate well with WES, and similar to EPD, DCP/WES share non-operating interests in major pipelines like Front Range and TX Express. However, PSX is likely more of a seller of assets right now, and there might be too much overlap in the DJ where WES and DCP are the top two processors already.

MPLX is another company that continues to invest in downstream NGLs, and WES could boost volumes on its BANGL pipeline and support further buildout of downstream assets like fractionators. WES' Rockies assets would also fit well with Williams (WMB) after its latest acquisition of Cureton and the remaining stake in Rocky Mountain Midstream, though the rest of the assets would be extraneous to WMB's core gas business.

In our view, Enterprise makes the most sense as a suitor for WES given the extensive asset overlap, followed by ET and MPLX. – James Taylor and Ajay Bakshani, CFA Tickers: EPD, ET, MPLX, OXY, WES, WMB.

New Webinar: 2024 Outlook for Permian NGL Growth and Dock Exports

Join East Daley’s Natural Gas Liquids Team on Wednesday, February 28 for a new online webinar on the NGL market outlook. In our latest webinar, EDA will discuss the outlook for Permian supply growth and the impacts to NGL markets. We review the potential for LPG dock constraints and how long bottlenecks may last. We also look at the propane storage and price outlook in 2024. Join us February 28.

New EDA Product: West Coast Supply & Demand

The West Coast Supply & Demand report is your go-to resource for mastering the energy market from the California coast to the western Colorado Rockies. This dynamic product offers extensive regional coverage, precise production forecasts for key basins, and in-depth pricing analysis, specifically examining the Colorado pricing spread from CIG Mainline to NW Pipeline Rockies.

Stay ahead of the competition with strategic insights, ensuring you make informed decisions and capitalize on emerging opportunities. Elevate your business with unparalleled market intelligence – invest in the West Coast Supply & Demand report today.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)