Quick Summary:

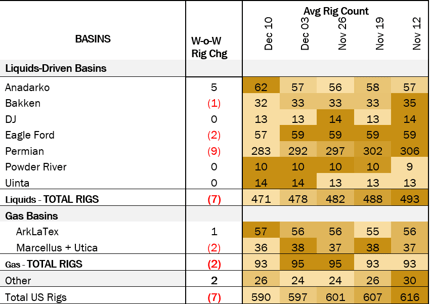

Rigs - The US rig count decreased by 7 W-o-W to bring the total count to 590.

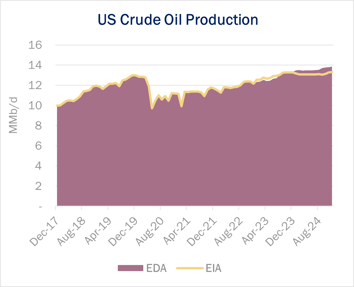

Production - The Energy Information Administration (EIA) expects US crude oil production to average 13.1 MMb/d in 2024, up from 12.9 MMb/d in 2023.

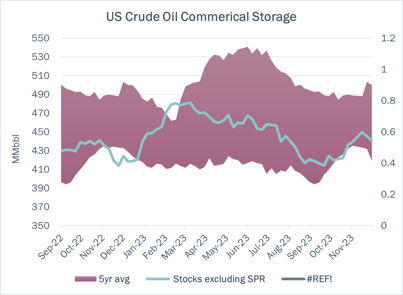

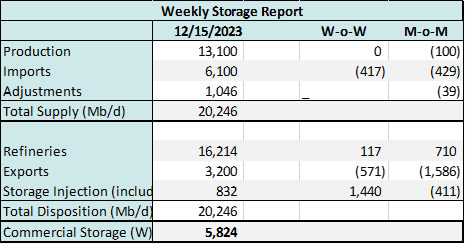

Storage: East Daley expects an injection of 832 MMbbl in commercial inventories for the week ending December 15.

Rigs:

The US rig count decreased by 7 W-o-W to bring the total count to 590. Liquids basins overall lost 7 rigs, including 9 rigs in the Permian, while the Anadarko gained 5 rigs.

The Eagle Ford and Bakken also saw a decrease of 2 and 1 rigs, respectively. The, DJ, Powder River and Uinta basins saw no change. Targa Resources (TRPG) is down 4 rigs with reductions on its Permian systems. Kinder Morgan (KMI) is down three rigs with losses on its Permian and ArkLaTex systems. West Texas Gas is up 2 rigs on its Permian systems.

Production:

The Energy Information Administration (EIA) expects US crude oil production to average 13.1 MMb/d in 2024, up from 12.9 MMb/d in 2023. The forecast is lower than East Daley’s current oil supply outlook in 2024.

On November 30, several OPEC+ countries announced additional voluntary cuts totaling 2.2 MMb/d, aimed at supporting the stability and balance of oil markets. Based on the OPEC+ agreement, EIA estimates Brent crude oil spot price will increase from $78/bbl in December to an average of $84/bbl in the first half of 2024, lower than its $93/bbl initially forecasted in the agency’s November STEO.

In the November Production Scenario Tools, East Daley forecasts total US crude production for 2024 of 13.58 MMb/d. The Permian Basin is the predominant growth engine and exits 2023 at 6.7 MMb/d, up 0.4 MMb/d Y-o-Y. The Eagle Ford exits 2023 at 1.0 MMb/d, down 0.1 Mb/d Y-o-Y.

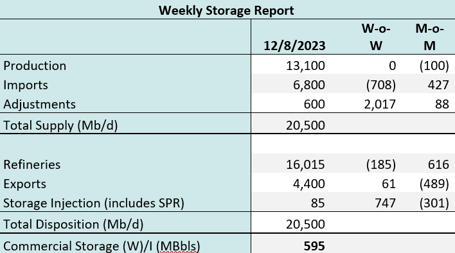

Storage:

East Daley expects an injection of 832 MMbbl in commercial inventories for the week ending December 15. We expect total US stocks, including the SPR, will close at 797.479 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased by 1.33% in liquids-focused basins. The Gulf of Mexico saw a significant change, gaining 4.9% W-o-W, and the Permian gained 2.4% W-o-W. The Gulf of Mexico has a high pipeline sample coverage; however, the Permian pipeline sample is less than 42%. We expect US crude production to be flat at 13.1 MMb/d.

According to US bill of lading data, US crude imports decreased by ~417 Mb/d W-o-W to 6.1 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Argentina and Brazil.

As of December 15, there was ~209 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by .7% W-o-W, coming in at ~16.21 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 15 vessels loaded for the week ending December 15 and 28 the prior week. EDA expects US exports to be 3.2 MMb/d.

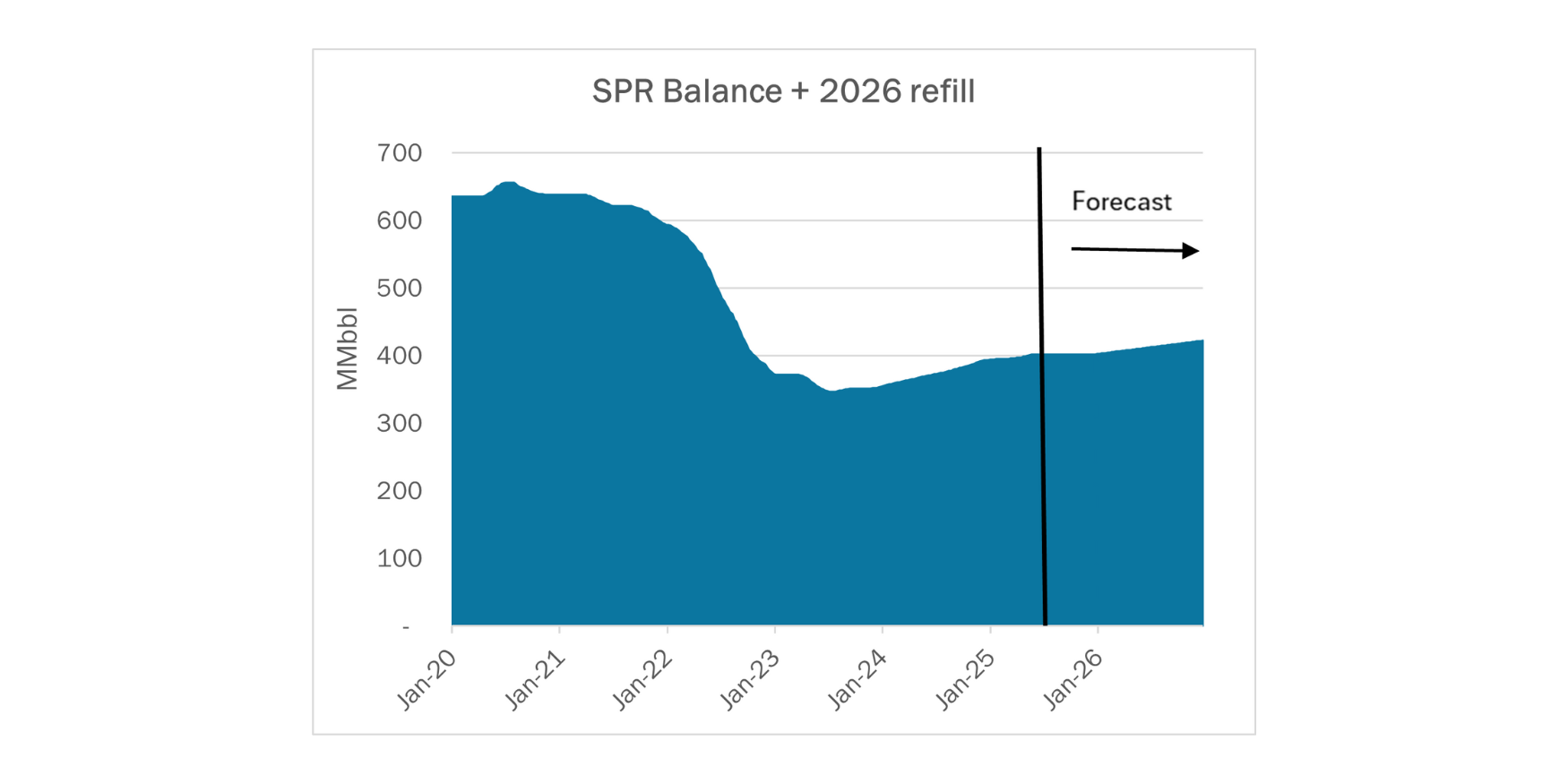

The Strategic Petroleum Reserve, SPR, awarded contracts for 2.73 MMbbl to be delivered to Big Hill SPR site in January 2024. The SPR also saw a 313 MMbbl storage injection the week ending December 1 and 8 which East Daley believes to be part of a .94 MMbbl restock delivered throughout Dec 2023.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

NuStar Logistics, L.P canceled one Incentive Rate program, and the volume commitments on two other Incentive Rate programs were lowered. Two Common Stream grades were also canceled under Rule 22. (IS24- 85, filed November 30, 2023)

Seaway Crude Pipeline Company LLC has extended the volume incentive rates through January 31, 2024. (IS24-123, filed December 8, 2023)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)