Rigs:

The US rig count increased by 2 W-o-W with total rigs settling at 602. Liquids basins gained 4 rigs W-o-W ending at 477. The Powder River gained 1 rig and the Permian gained 3. All others basins held steady with no change.

Civitas gained a rig in the DJ Basin. Oxy, Devon, Vencer Energy and Point Energy gained 1 rig each in the Permian.

Infrastructure:

Michigan regulators have approved an application by Enbridge (ENB) to replace a segment of the Line 5 pipeline running under the Great Lakes, removing one legal hurdle for the oil pipeline.

On December 1, the Michigan Public Service Commission (PSC) approved ENB’s application to replace a segment of pipelines now located on the lakebed of the Straits of Mackinac between Lake Michigan and Lake Huron (see map). ENB proposes to replace them with a single pipeline buried in a concrete tunnel deep below the lakebed.

Line 5 transports up to 540 Mb/d of light crude oil and NGLs from Superior, WI to Sarnia, ON. The pipeline is a key source of propane used for heating homes in Michigan.

In the ruling, the PSC found a public need for the replacement project. The agency determined “that without the pipeline’s operation, suppliers would need to use higher-risk and costlier alternative fuel supply sources and transportation for Michigan customers.”

ENB needs additional approvals from the US Army Corps of Engineers to move ahead with the Line 5 replacement project. The PSC approvals also comes with conditions related to the tunnel’s safety and construction.

Enbridge is juggling multiple legal issues around Line 5. In June 2023, a US district judge ordered the company to move a 12-mile segment of the pipeline near Ashland, WI that crosses into lands of the Bad River Band of the Lake Superior Chippewa. The tribe alleges Line 5 is at risk of exposure and rupturing after erosion from heavy rains. The judge agreed and gave ENB three years to relocate the pipeline, a window that would end on July 16, 2026. ENB proposes to replace the segment with 41 miles of pipeline running around the tribe’s land.

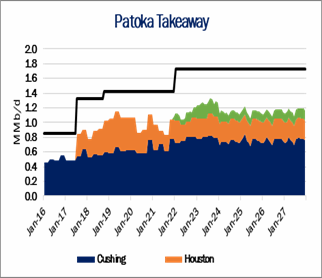

East Daley Analytics’ Crude Hub Model tracks all pipelines carrying crude oil into the Patoka, IL refinery and storage hub (see figure).

Storage:

East Daley expects an injection of 595 MMbbl in commercial inventories for the week ending December 8. We expect total US stocks, including the SPR, will close at 801.347 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased by 0.6% in liquids-focused basins. The Bakken saw a significant change, gaining 2.9% W-o-W, whereas the Permian saw a 2.9% reduction W-o-W. The Williston Basin has high pipeline sample coverage, whereas East Daley expects the Permian pipeline sample to be less than 42%. We expect US crude production to be flat at 13.1 MMb/d.

According to US bill of lading data, US crude imports decreased by ~708 Mb/d W-o-W to 6.8 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Argentina and Brazil.

As of December 8, there was ~326 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by 1.1% W-o-W, coming in at ~16.02 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 28 vessels loaded for the week ending December 8 and 25 the prior week. EDA expects US exports to be 4.4 MMb/d.

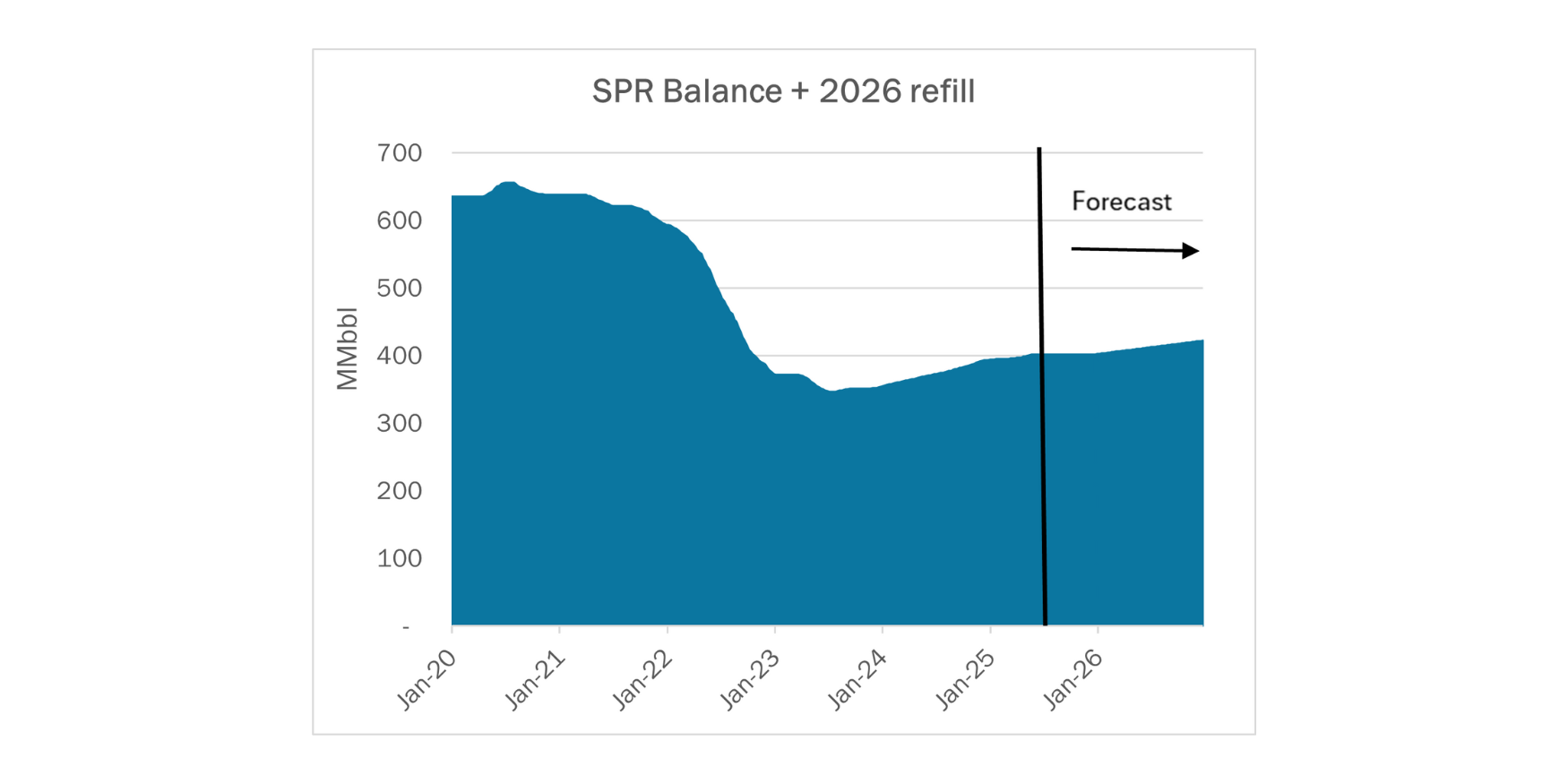

The Strategic Petroleum Reserve (SPR) awarded contracts for 2.73 MMbbl of storage to be delivered to the Big Hill SPR site in January 2024. The SPR also saw a 313 MMbbl storage injection the week ending December 1 which East Daley believes to be part of a 1.2 MMbbl restock delivered through December 2023.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

Enbridge Energy, LP has increased the committed and uncommitted joint international tariff rates, reflecting an increase in the Line 3 replacement surcharge. Joint rates are less than or equal to the sum of the local rates. (IS24- 31, filed November 16, 2023)

Zydeco Pipeline Company LLC has increased the volumetric incentive rates per the terms of the agreements. Changes are effective January 1, 2024. (IS24-33, filed November 17, 2023)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)