Executive Summary:

Infrastructure: A fire at the Monaca petrochemical complex could cause waves in the Northeast ethane market.

Rigs: The US rig count fell by 10 during the week of May 25 to 541. Liquids-driven basins decreased by 5 W-o-W from 432 to 427.

Flows: For the week ending June 8, US natural gas volumes averaged 69.8 Bcf/d in pipeline samples, marking a W-o-W increase from 69.7 Bcf/d the previous week.

Calendar: June 16 - EDA plant data updates

Infrastructure:

A fire at Shell’s (SEL) Monaca petrochemical complex could cause waves in the Northeast ethane market.

On June 4, an explosion occurred at one of the seven furnaces at the Monaca cracker in Beaver County, PA. Several employees were evacuated, and the Pennsylvania Department of Environmental Protection sent staff to evaluate the incident. Shell has provided no timeline for restarting the furnace.

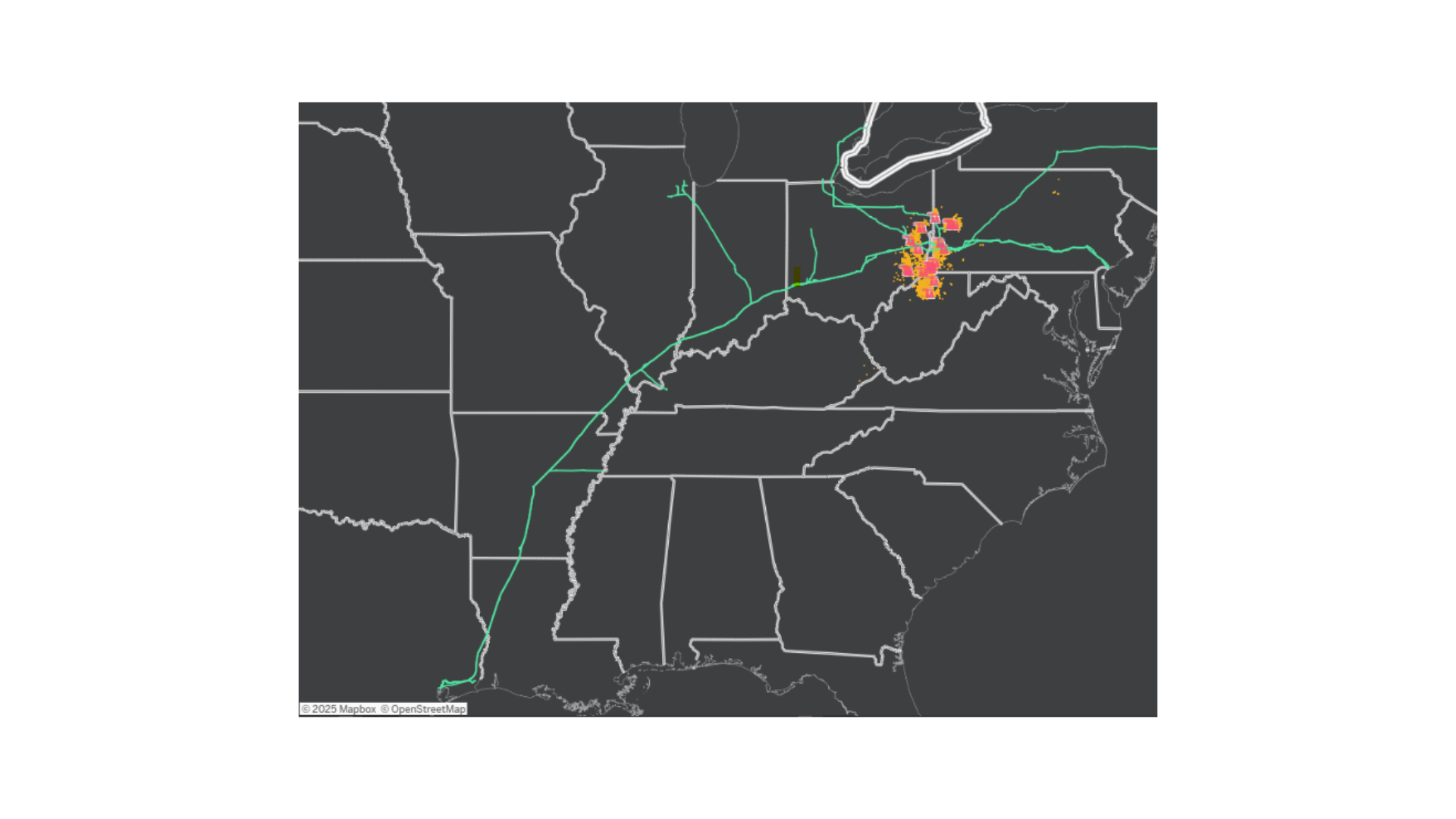

Falcon, the pipeline supplying ethane to Monaca, had been ramping volumes before this incident, reaching 85-90% utilization over the past two quarters, according to East Daley’s Ethane Supply & Demand Report. Now that one of the furnaces is down, those volumes may be rerouted to flow through Enterprise’s (EPD) ATEX Pipeline to the Gulf Coast – Shell is known to have contracted capacity on ATEX. Another option is to send displaced volumes to NOVA Chemical’s Corunna Cracker in Sarnia, Ontario via Kinder Morgan’s (KMI) Utopia or Energy Transfer’s (ET) Mariner West pipelines. The map shows these and other NGL pipelines from the Energy Path - Northeast dashboard in Energy Data Studio.

The Monaca complex can consume 105 Mb/d of ethane when running at full capacity, or ~15 Mb/d per furnace. How much of this supply will hit the market is unclear. According to local sources, the complex is still running. East Daley will continue to monitor the situation.

Rigs:

The US rig count decreased during the week of May 25 to 532. Liquids-driven basins decreased by 5 W-o-W from 431 to 424.

- Permian (-3):

-

- Delaware (-2): Vital Energy, BP

-

- Midland (-1): Vital Energy

- Anadarko (-1): Downing-Nelson Oil

- Bakken (-1): Zarvona Energy

Flows:

For the week ending June 8, US natural gas volumes averaged 69.8 Bcf/d in pipeline samples, marking a W-o-W increase from 69.7 Bcf/d the previous week.

Liquids-driven basins decreased 0.1 Bcf/d to 18.0 Bcf/d. The Permian Basin increased 2.3% W-o-W to average 5.8 Bcf/d, with the Eagle Ford decreasing 8.0% to 1.5 Bcf/d.

Gas-driven basins were relatively flat W-o-W, averaging 44.2 Bcf/d. The Barnett increased by 8.4% from 0.85 Bcf/d to 0.93 Bcf/d. The Marcellus+Utica was relatively flat W-o-W.

Looking ahead, the Appalachia and Haynesville basins will be pivotal to monitor. With increased demand on the horizon, we expect increased production from these regions will be critical to maintain a balanced market.

-2.png?width=617&height=582&name=Untitled%20design%20(28)-2.png)

Calendar:

-1.png)