Executive Summary: Rigs: The total rig count decreased by 1 for the July 17 week, down to 553 from 554.Flows: The US interstate gas sample is down 0.5 Bcf/d (~1%) W-o-W for the week of July 14. Infrastructure: Can US propane storage inventory levels top 100 MMbbl in 2024? Purity Product Spotlight: US hydrocarbons are levered to international demand like never before.

Rigs:

The total rig count decreased by 1 for the July 17 week, down to 553 from 554. Liquids-driven basins saw an increase of 1 rig, increasing the total count from 448 to 449. The Bakken and DJ basins both decreased by 1 rig, whereas the Permian Basin decreased by 3.

In the Bakken, operator Chord Energy removed 1 rig from its system. In the DJ, Bison Operating dropped 1 rig. In the Permian Basin, Delaware operators EOG Resources (EOG) and Coterra Energy (CTRA) each decreased rigs by 1, and Midland operator Exxon (XOM) also released 1 rig.

Flows:

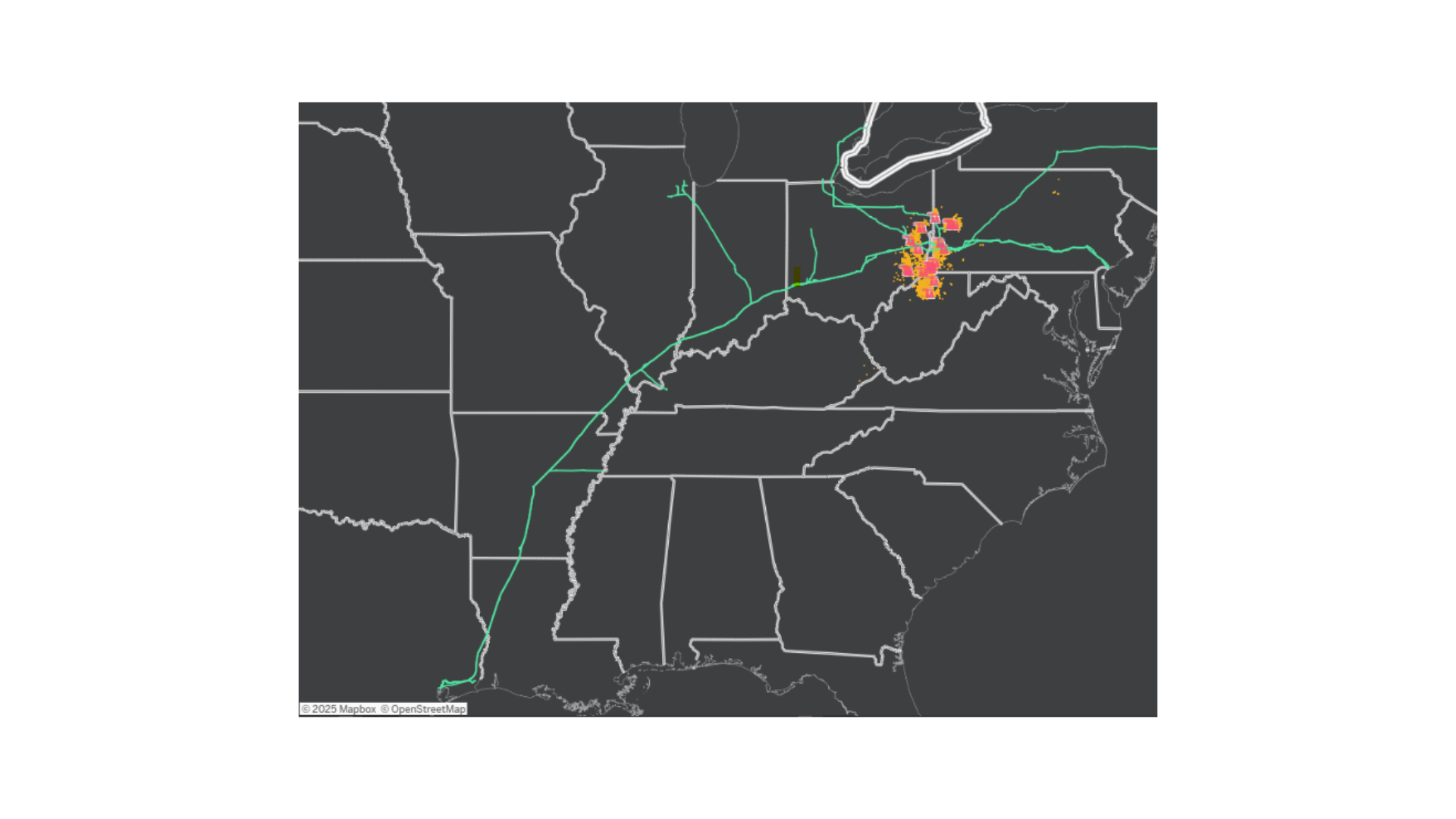

The US interstate gas sample is down 0.5 Bcf/d (~1%) W-o-W for the week of July 14. In liquids-driven basins, a couple maintenance events have impacted the flow sample. In the Eagle Ford, Transcontinental Gas Pipeline had a scheduled outage on Mainline A and B starting July 8 until July 26, which will possibly impact availability of transportation services out of the basin. The Bakken flow sample is also down due to the Alliance Pipeline having unplanned outages at third-party processing plants, reducing capacity at some delivery point in the Midwest starting July 11 until further notice.

In gas-driven basins, sample fell 4% in the ArkLaTex (Haynesville) as producers are tailoring flow due to cooler weather expectations in the short term. We expect flat production moving forward until new demand comes from the Plaquemines and Golden Pass LNG facilities projects.

Infrastructure:

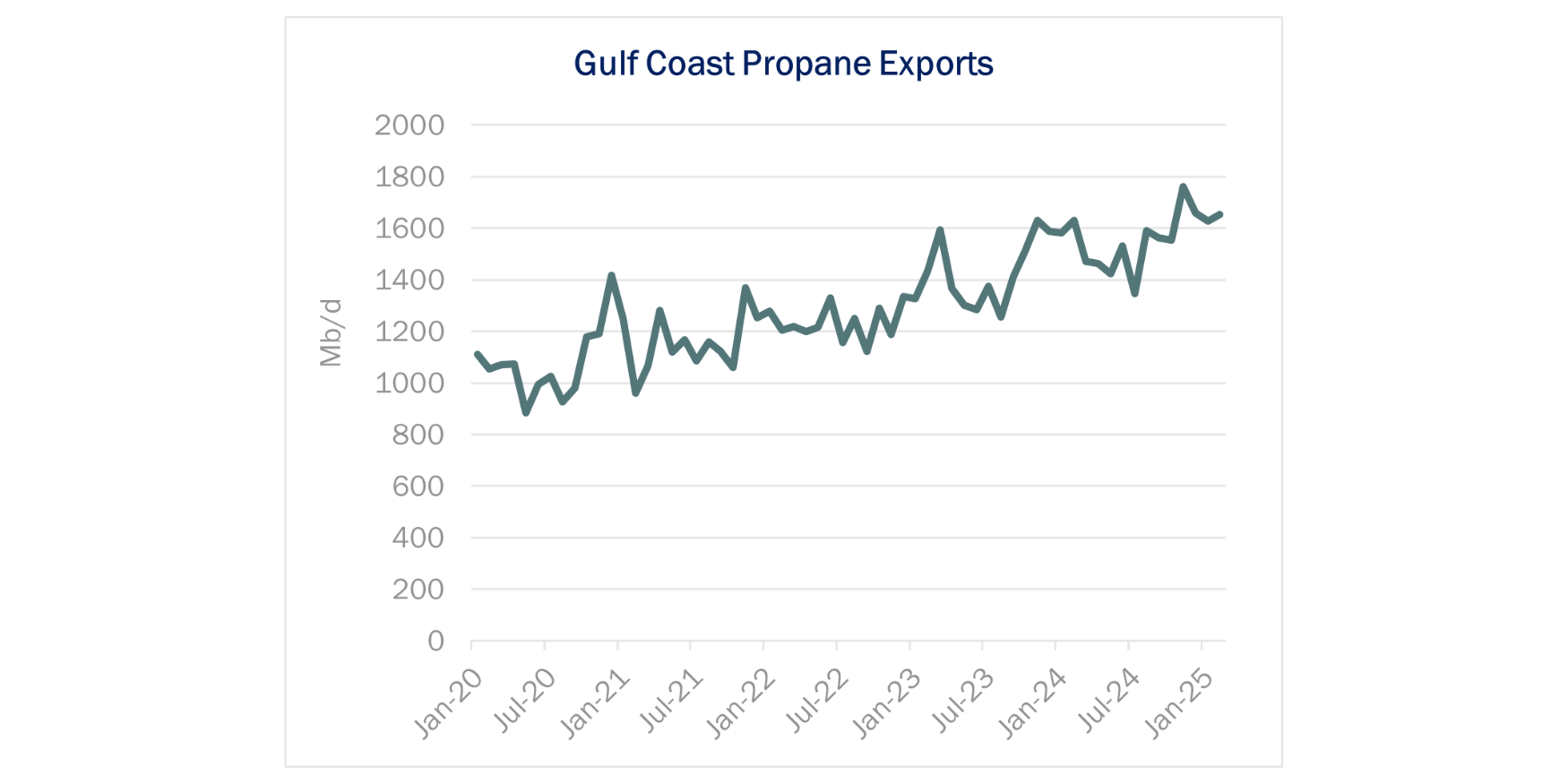

Can US propane storage inventory levels top 100 MMbbl in 2024? After a mild winter, the topic is front and center among NGL traders as an indicator of possible constraints ahead. East Daley would take the over on that bet. We have discussed this benchmark in the monthly Propane Supply & Demand Report, and now see supply and demand factors that should keep restocking above the 100 MMbbl mark due to Hurricane Beryl.

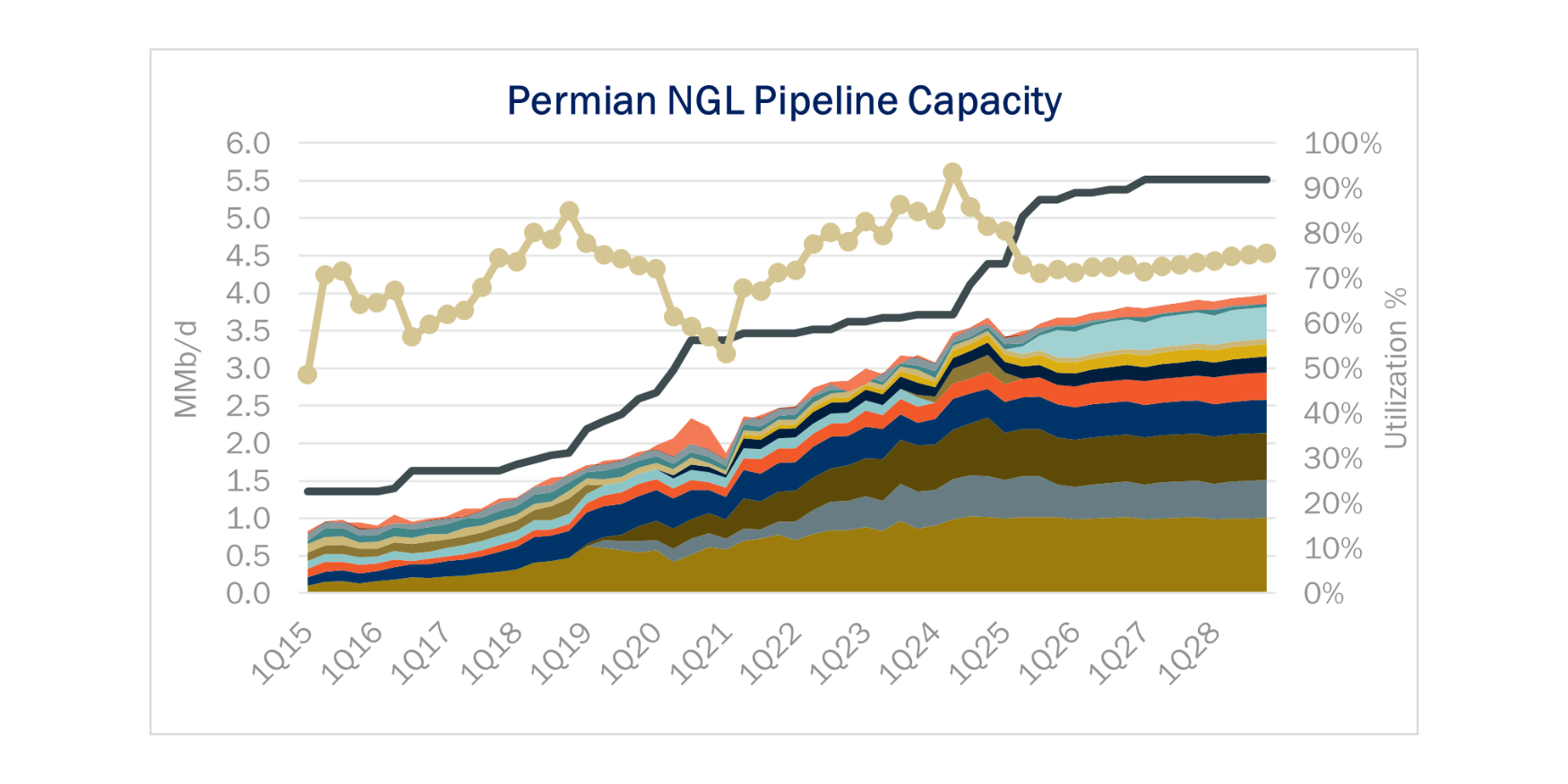

On the supply side, propane production has struggled out of the gate this year. Winter Storm Heather put a dent in January ’24 production for oil and gas – and it did the same to propane supply. The decline in propane production of almost 50 Mb/d (2%) from March to June ’24 is a result of lower overall Permian supply. The basin is constrained by tight gas egress, and pipeline maintenance on Permian Highway Pipeline (PHP), Gulf Coast Express (GCX), and El Paso Natural Gas (EPNG) further reduced supply in April and May.

The pressure should be alleviated when the Matterhorn pipeline comes online in September ’24, and that’s when we expect propane supply to pick up steam. This is consistent with what producers like Chevron (CVX) guided to early in the year with most growth being back-half weighted.

At the same time, propane demand has been strong. The weekly EIA data on US Exports of Propane & Propylene is up 17% so far in 2Q24 vs 2Q23. The early indication is that Gulf Coast propane exports will match those gains. Enterprise (EPD), Energy Transfer (ET), Targa Resources (TRGP) and Phillips 66 (PSX) will likely comment on the persistent strength of international demand being a tailwind for dock volumes in the quarter.

Hurricane Beryl has thrown a wrench into Gulf Coast LPG exports in July ‘24. EDA’s forecast for LPG exports during the month will be revised down in the Propane Supply & Demand Report as Beryl has prevented the normal movement of Very Large Gas Carriers (VLGCs) through the Houston Ship Channel, which means more propane has found a temporary home in storage along the Gulf Coast. We expect propane exports to bounce back starting in the second half of July, but the logistical hiccup caused by Mother Nature will push propane storage above 100 MMbbl by September ’24 in our new forecast.

Purity Product Spotlight:

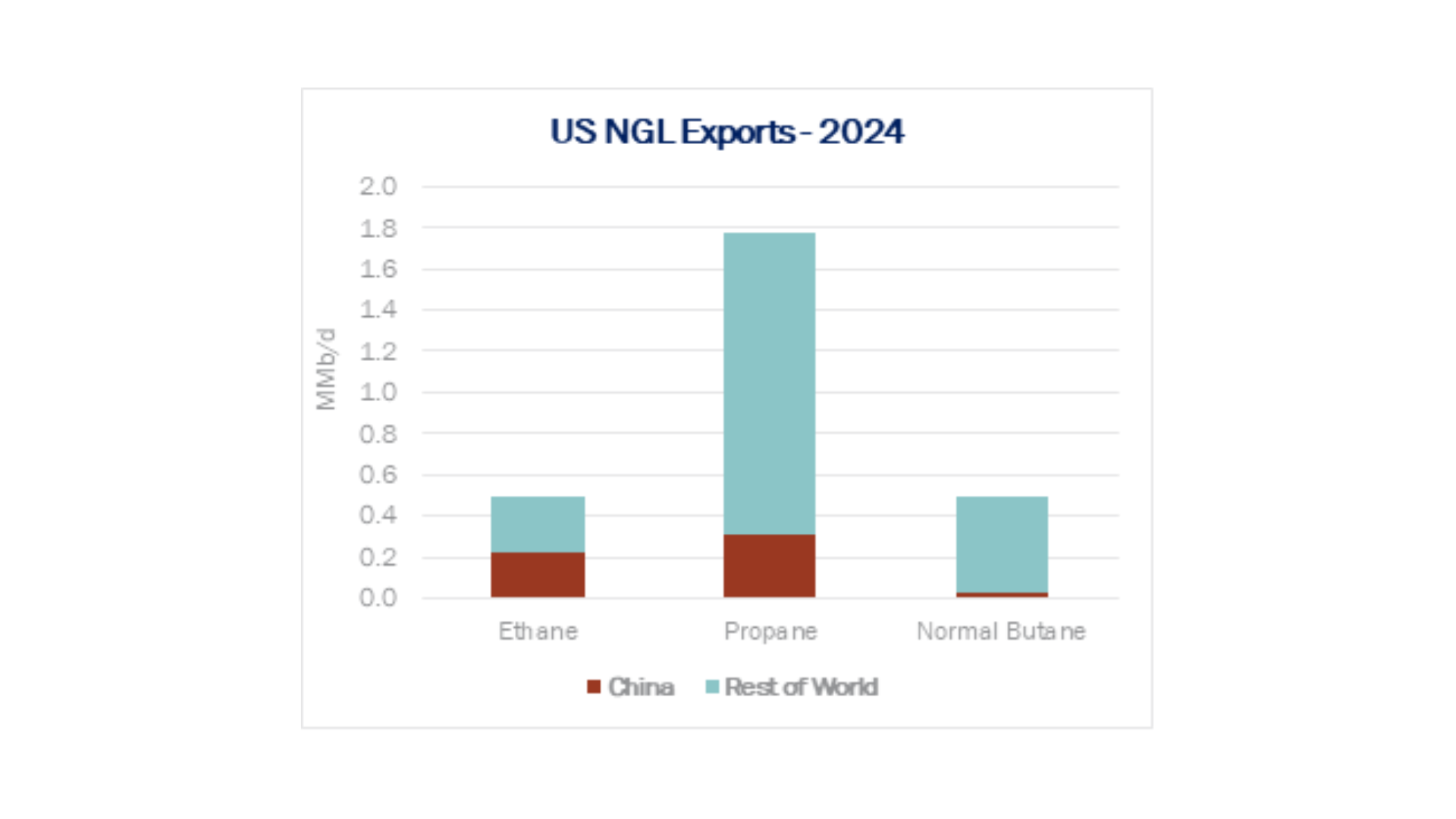

US hydrocarbons are levered to international demand like never before. Propane is no different, with more than 2/3 of demand coming from international buyers. Hurricane Beryl has caused a temporary disruption. The market center – Mont Belvieu – linking propane supply to international buyers has been put on pause so vessles shipping LPGs (propane in the form of liquids). That means propane has found a temporary home in storage and we have seen a decline in price as a result (refer to the figure).

Data Points & Product Release Calendar:

-1.png)