Executive Summary: Rigs: The total US rig count decreased by 2 rigs W-o-W, and liquids-driven basins saw no change at 489 rigs for the week ending March 3. Flows: As of March 17, the US interstate gas sample dropped 1% W-o-W, mainly driven by declines in gas-focused basins. Infrastructure: East Daley highlighted last week how the lifting of a nighttime transport ban from the Houston Ship Channel (HSC) has increased operating capacity at some LPG docks. Purity Product: In last week’s NGL Insider, we noted the sharp decline in propane prices to start 2024.

Rigs:

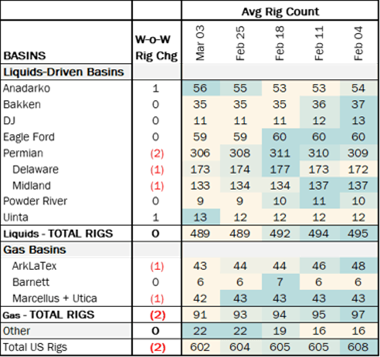

The total US rig count decreased by 2 rigs W-o-W, and liquids-driven basins saw no change at 489 rigs for the week ending March 3. The Permian Basin lost 2 rigs, and the Anadarko and Unita each gained 1 rig. All other basins saw rig counts hold steady.

*W-o-W change is for the two most recent weeks.

In the Midland Basin, Pioneer Resources and Birch Resources each dropped 1 rig for the March 3 week, whereas Ike Operating added 1 rig. In the Delaware, Petro-Hunt added 1 rig and Exxon and Devon each dropped 1 rig. In the Uinta, Blackstone Resources added 1 rig, and Edison Operating added 1 rig in the Anadarko.

Flows:

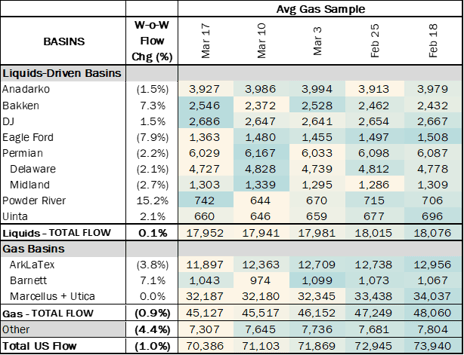

As of March 17, the US interstate gas sample dropped 1% W-o-W, mainly driven by declines in gas-focused basins. Natural gas prices are trading under $2/MMBtu, and the effects of low prices are starting to show up in samples for gas basins. In the Northeast and ArkLaTex, producers like EQT and Chesapeake (CHK) are curtailing production and delaying the start of new wells.

*W-o-W change is for the two most recent weeks.

The Bakken sample rebounded 7% for the week ended March 17 after a 6% W-o-W decline the previous week. The decline earlier in March appears to be a weather-related blip after a winter storm moved through the Midwest and Rockies. The Powder River Basin is also up sharly W-o-W, still recovering from weather impacts to supply.

Offsetting these gains, the Eagle Ford sample declined 7.9% W-o-W. The decline is occuring mostly behind Eagle Ford G&P systems owned by Energy Transfer (ET) and Targa Resources (TRGP) on Tennessee Gas Pipeline and Texas Eastern, respectively. The declines on Tennessee and Texas Eastern are not great predictors of production because both midstream copmanies have several other residue outlets on inter- and intrastate pipelines. No cause for concern in the Eagle Ford yet.

Infrastructure:

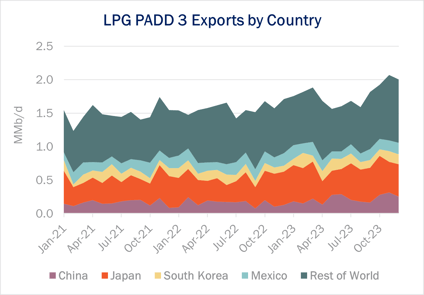

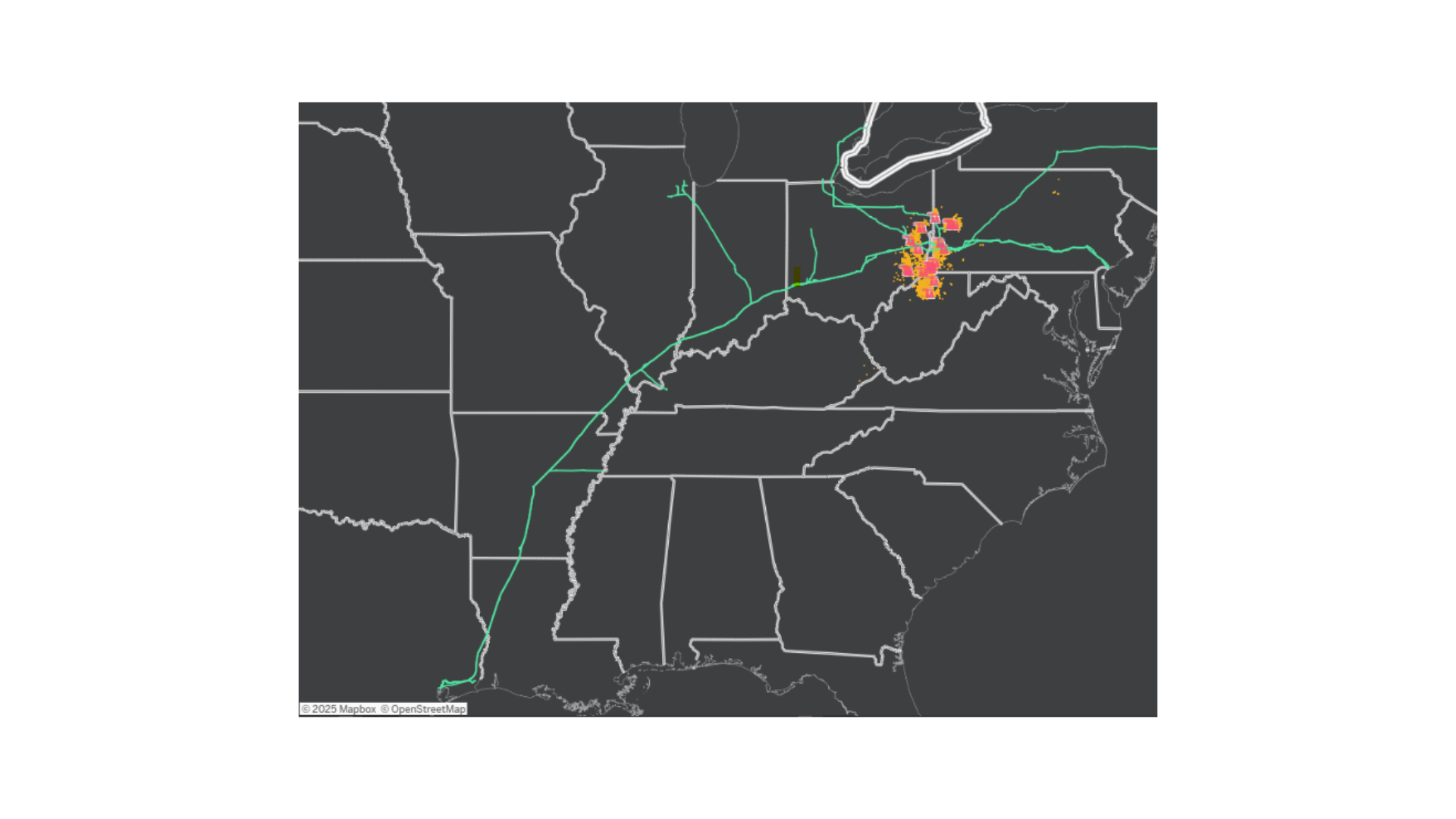

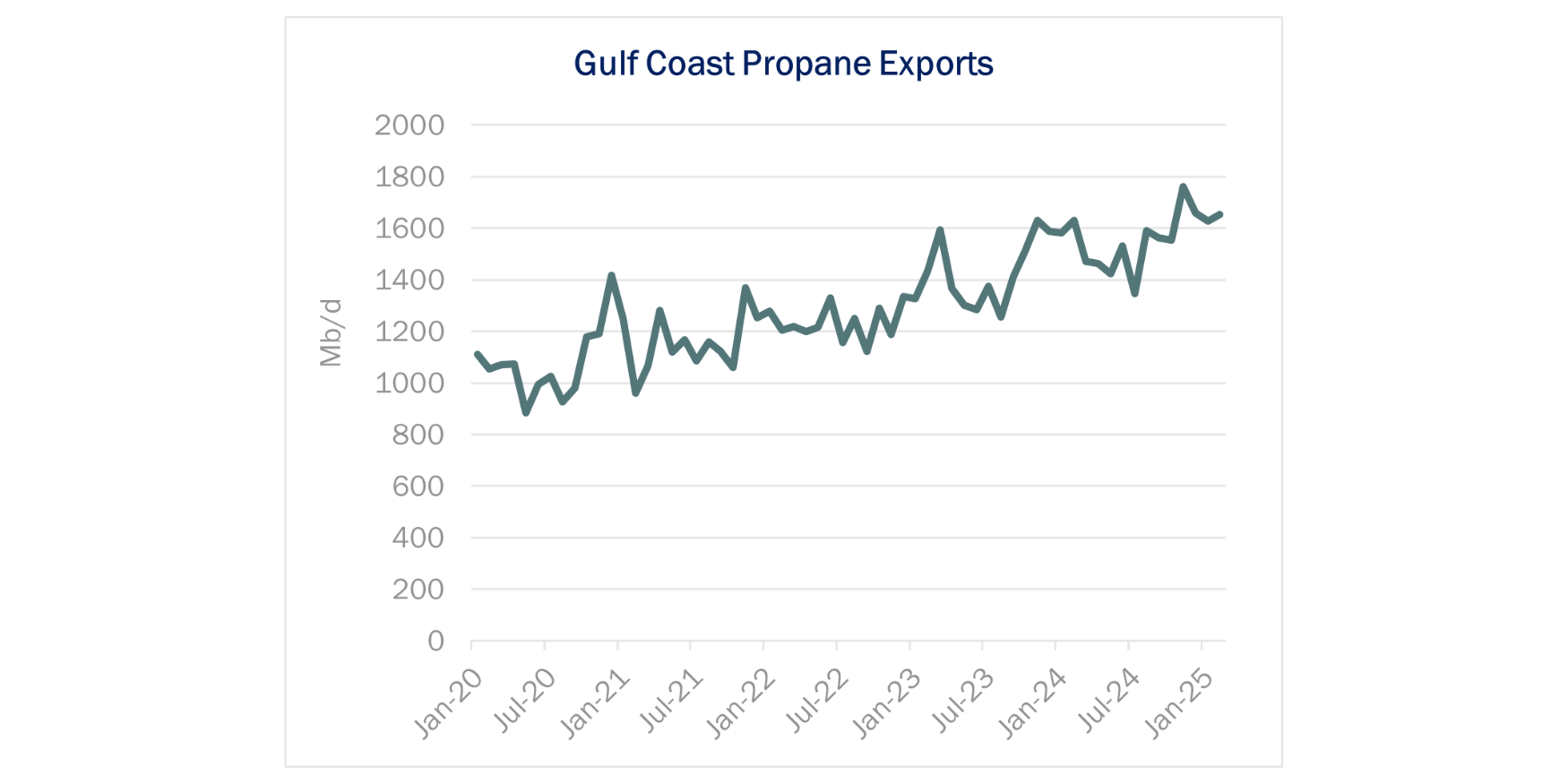

East Daley highlighted last week how the lifting of a nighttime transport ban from the Houston Ship Channel (HSC) has increased operating capacity at some LPG docks. 24x7 piloting raises potential exports by an estimated 5-10% for operators like Targa (TRGP) and Enterprise (EPD) at a time when spare capacity is scarce.

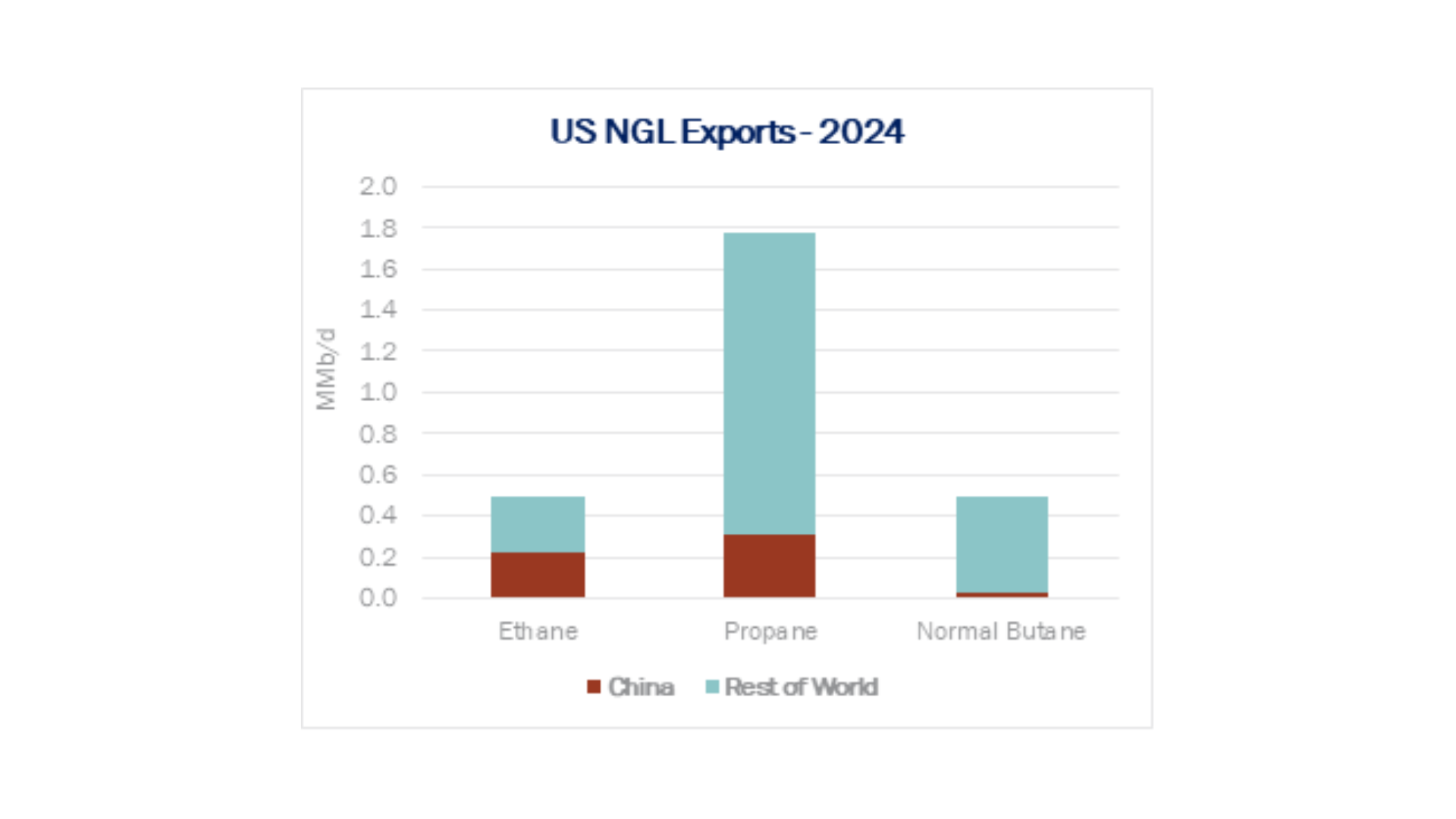

Another factor that could provide a relief valve is more exports to Mexico. About 10% of total LPG exports are destined to our neighbors to the south (see light blue shaded area of the figure). From 2021 to 2023, exports to China, Japan, and South Korea grew at a CAGR of 17%, 15% and 10%. By contrast, Mexico’s demand for US propane and normal butane has been stable at ~155-160 Mb/d.

Anecdotally, EDA understands LPGs transported to northern Mexico are sent via rail while exports to southern Mexico are loaded onto LPG vessels. According to Union Pacific, two major railroads operate in Mexico: Ferromex (FXE) and Canadian Pacific Kansas City (CPKS). FXE has two cross-border locations in Texas, one in El Paso and one at Eagle Pass. CPKC has cross-border locations at Laredo and Brownsville, TX.

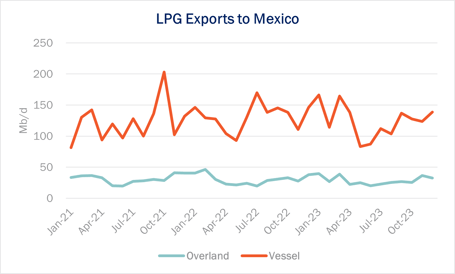

In the graph below, we assume LPG exports at El Paso and Laredo (as captured in US Customs data) are moved by truck or rail, while LPG exports at Houston and Port Arthur are loaded onto vessels. If are assumptions are correct, there is about 30 Mb/d of propane and butane railed to northern Mexico.

If we are correct, overland LPG transport doesn’t appear to offer much upside in working around the LPG dock bottleneck. Between 24x7 HSC piloting and a small slice of exports going overland, EDA could only uncover a grand total of 130 Mb/d of additional “effective” LPG dock capacity in PADD 3 of our NGL Network Model.

Purity Product Spotlight:

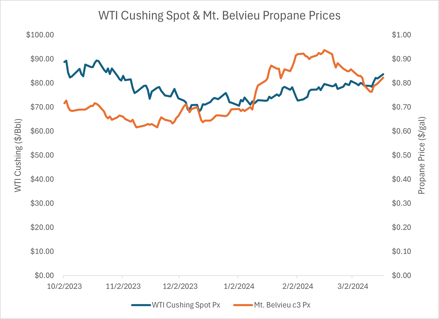

In last week’s NGL Insider, we noted the sharp decline in propane prices to start 2024. Propane prices have bounced back hard, up almost 8% at Mt. Belvieu over the past five days. While propane has not always tracked WTI Cushing, the commodities have rebounded in tandem, with the latter up almost 7% over the same period. It could be that speculation around interest rate cuts by central banks will spur demand. With much of the growth expected from China for both crude oil and propane, it's not illogical that prices would react on the news similarly despite being completely uncorrelated in price movement over the past six months (see chart below).

-1.png)