Executive Summary: Rigs: The total US rig count decreased by 2 rigs W-o-W, down to 584 from 586 for the week ending April 7. Flows: The US interstate flow sample is flat W-o-W for the week of April 21. Infrastructure: Enterprise Products (EPD) plans to convert its Seminole Pipeline back to crude oil service next year, the latest flex by EPD for the multi-use pipeline. Purity Product: Mont Belvieu propane prices appear to be settling down to pre-winter prices despite WTI crude oil staying relatively flat.

Rigs:

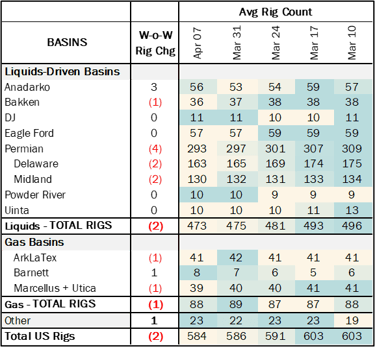

The total US rig count decreased by 2 rigs W-o-W, down to 584 from 586 for the week ending April 7. In Liquids-driven basins, the Anadarko and Permian made the largest impact on overall rig count. The Anadarko Basin gained 3 rigs, while the Permian lost 4 rigs W-o-W. The Delaware and Midland each lost 2 rigs.

ConocoPhillips and Occidental each removed 1 rig W-o-W from their Permian – Delaware systems, while Pioneer Natural Resources subtracted 2 rigs from its system in the Midland. Anadarko operators Aztec Oil Operating, Mewbourne Oil, and Valpoint Operating each added 1 rig W-o-W, bringing the basin total to 56 rigs.

Flows:

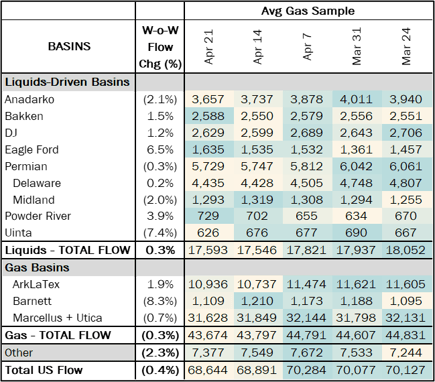

The US interstate flow sample is flat W-o-W for the week of April 21. The gas sample suggests volumes in Liquids-focused basins are flat overall. The gas sample is also flat.

The 0.2 Bcf/d increase in the ArkLaTex sample is a moral victory following a precipitous decline in production over the the last two months. As covered in The Daley Note, Haynesville producers appear to be curtailing deliveries to pipelines to minimize the hit of low natural gas prices. The weak deliveries are creating headaches for pipelines and leading supply to decline much faster than East Daley had expected.

For example, Energy Transfer’s (ET) ETC Tiger Pipeline has issued multiple critical notices of underperformance in April, citing unexpectedly low deliveries from several gathering system interconnects. ETC Tiger, which typically moves ~2.3 Bcf/d from the Haynesville to the Perryville hub, has reported over 300 MMcf/d in declines M-o-M.

Infrastructure:

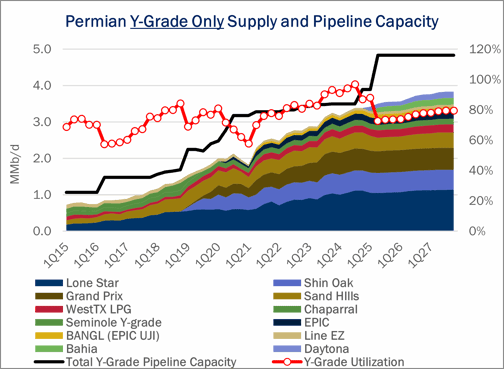

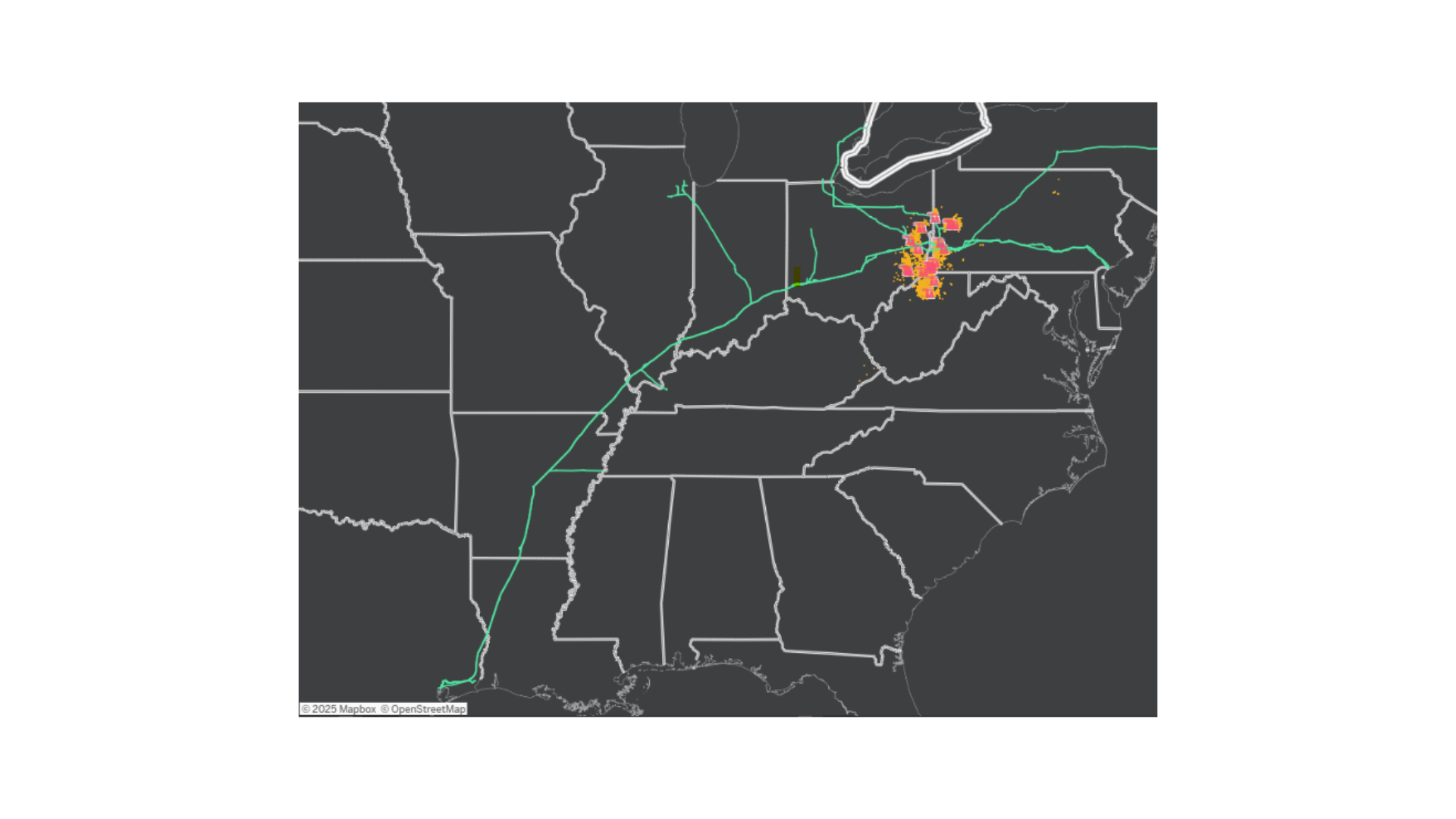

Enterprise Products (EPD) plans to convert its Seminole Pipeline back to crude oil service next year, the latest flex by EPD for the multi-use pipeline. The project is part of a push by midstream companies to add Permian oil egress capacity over the next 12-16 months.

At the company’s investor day presentation, EPD confirmed plans to return the 200 Mb/d Seminole (formerly known as Midland-to-Echo 2, or M2E2) from transporting NGLs back to crude oil later in 2025. The conversion follows an announcement last month by Enbridge (ENB) to expand Gray Oak Pipeline by ~120 Mb/d from the Permian to Corpus Christi.

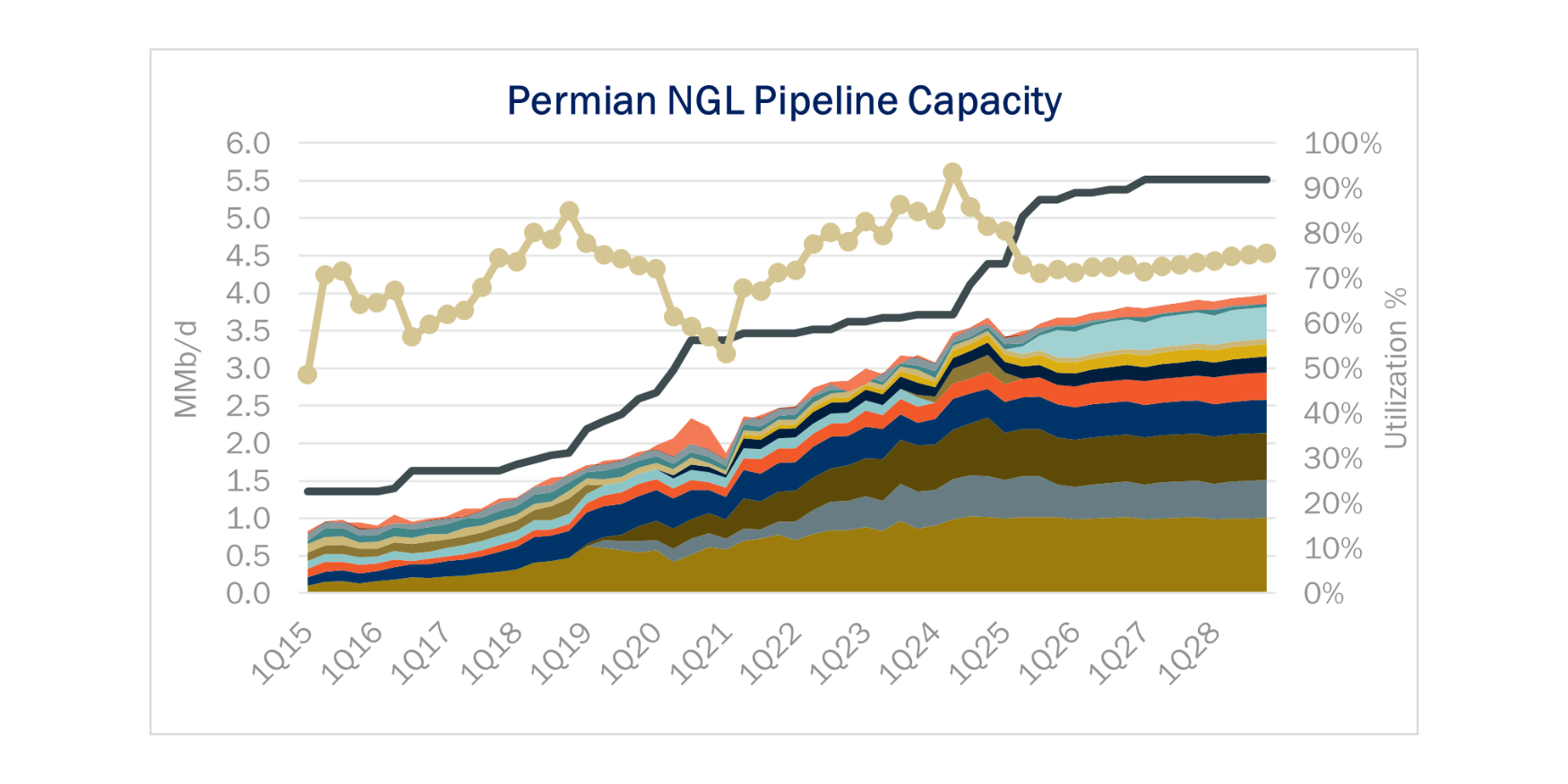

The move by Enterprise will remove slack out a Permian NGL takeaway market that will be running at low-70% utilization rates once Grand Prix and Bahia NGL pipelines begin operations in early 2025 (see figure below).

Purity Product Spotlight:

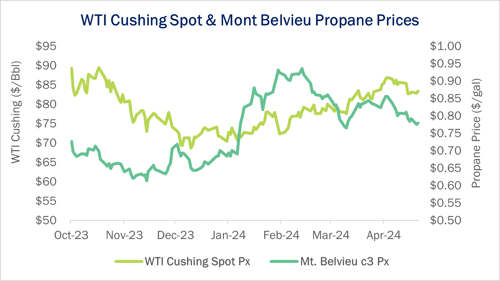

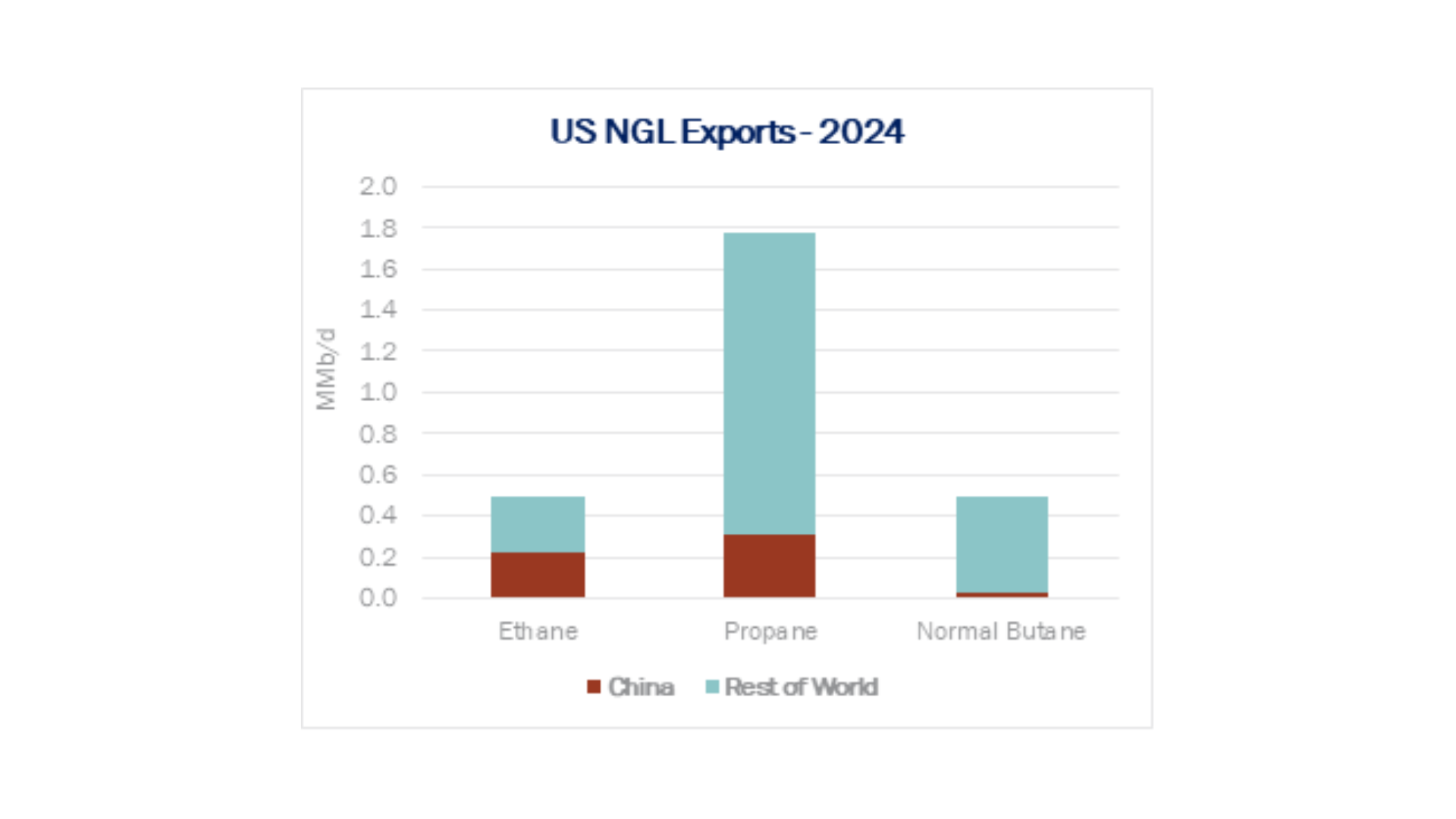

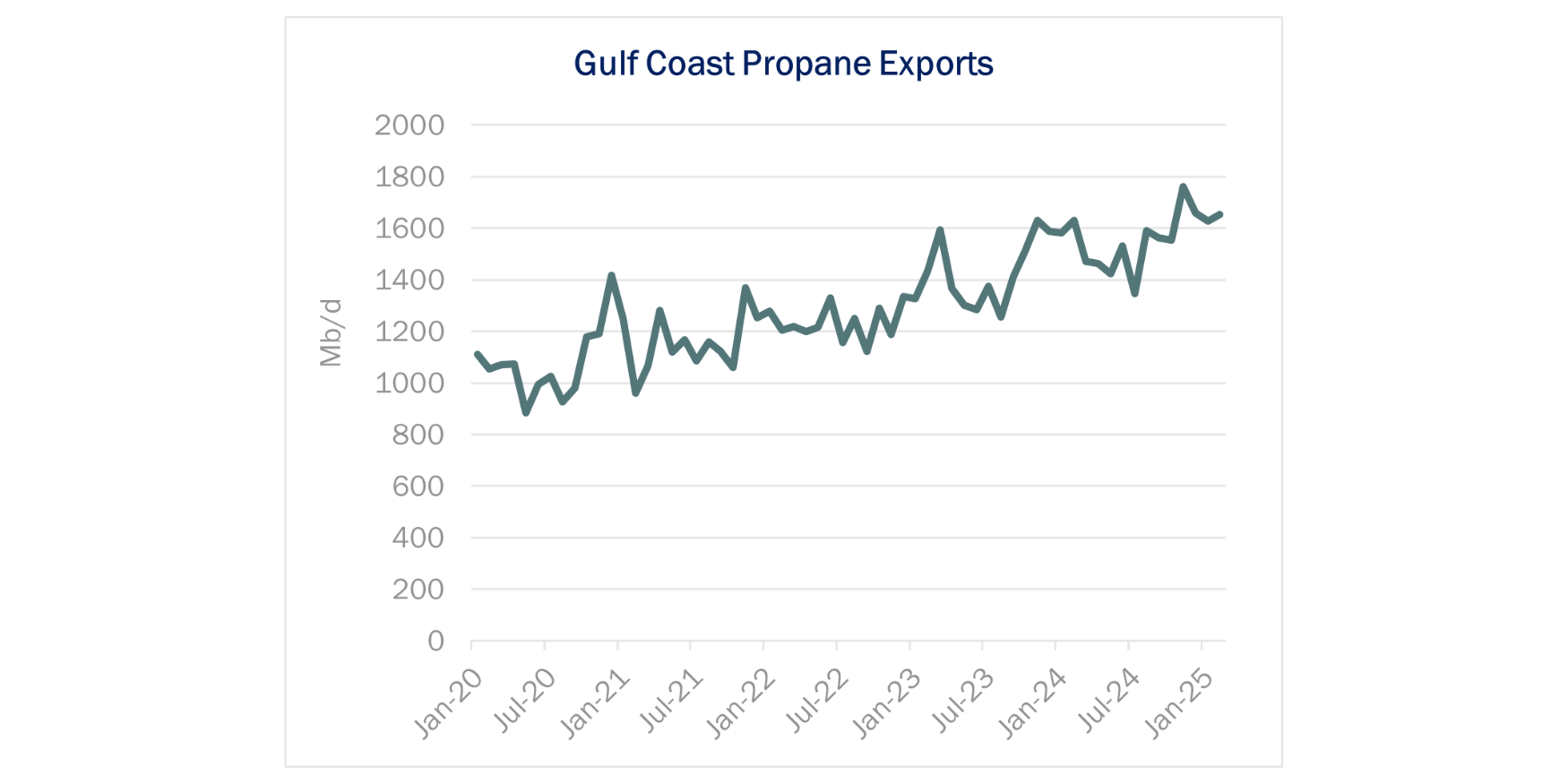

Mont Belvieu propane prices appear to be settling down to pre-winter prices despite WTI crude oil staying relatively flat (see figure below). It’s unclear if this is due to lower heating demand as the winter closes, a ramp-up in US propane supply after weather disruptions in mid-January, lower domestic steam-cracker furnace utilization rates, or a combination of all three. A demand drop seem seems unlikely given a 730 Mb/d Y-o-Y increase from the US, China and India from February ’23 to February ’24, according to OPEC data.

-1.png)