Executive Summary: Rigs: The total US rig count increased by 2 rigs W-o-W, up to 581 from 579. Flows: The US interstate flow sample is up slightly W-o-W for the week of April 28, resulting from increases in the Anadarko, Eagle Ford, Powder River and Uinta basins. Infrastructure: East Daley wrote about the earnings outlook for Targa Resources (TRGP) in an earlier note to clients, and the company met our expectations in strong 1Q24 results. Purity Product: Sticking with Targa, the company managed to squeeze out a record 439 Mb/d of LPG exports from its Galena Park terminal in earnings posted Thursday morning (May 2).

Rigs:

The total US rig count increased by 2 rigs W-o-W, up to 581 from 579. Liquids-driven basins held flat W-o-W as the Anadarko and Permian each gained 1 rig. The DJ and Eagle Ford basins both lost 1 rig. In the Permian, the Delaware lost 1 rig while the Midland gained 2 W-o-W.

Among operators, Civitas Resources dropped a rig in the DJ Basin, while EOG Resources subtracted 1 rig in the Eagle Ford. Charter Oak Production Co. in the Anadarko added 1 rig W-o-W. Permian operators Ovintiv and Diamondback Energy each added 1 rig W-o-W in the Midland, while Devon Energy in the Delaware dropped 1 rig.

*W-o-W change is for the two most recent weeks.

Flows:

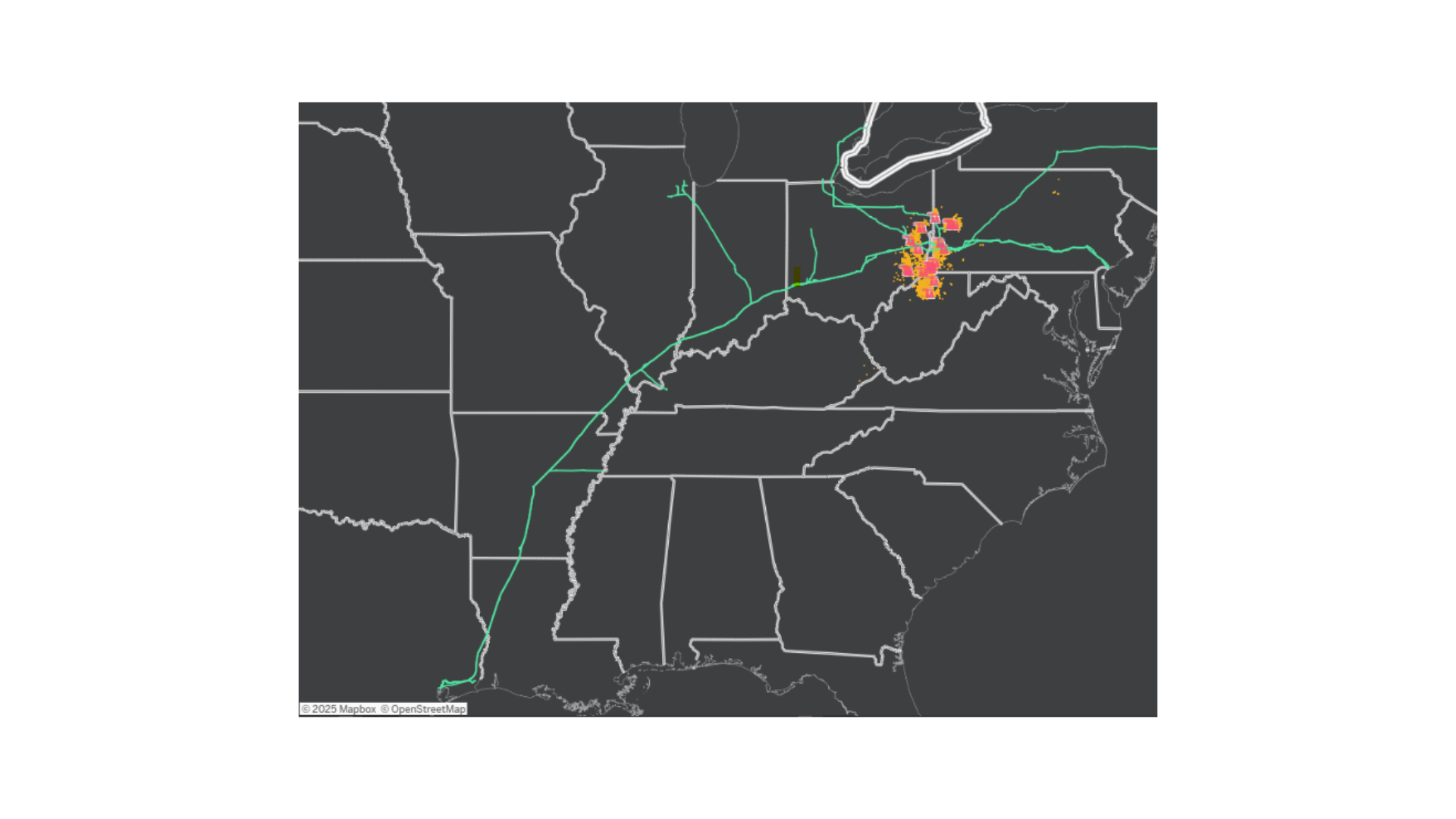

The US interstate flow sample is up slightly W-o-W for the week of April 28, resulting from increases in the Anadarko, Eagle Ford, Powder River and Uinta basins. The Eagle Ford sample is unreliable with less than 25% of gas visibility on interstate pipelines, but we have seen an uptick in volumes in reliable plant data through March after Winter Storm Heather, so the growth into April is likely legitimate.

The Permian, Northeast and Haynesville continue to steer this market, and the gas samples for all three basins is lower W-o-W. Pipeline maintenance on Kinder Morgan’s (KMI) El Paso’s North mainline and Gulf Coast Express (GCX) is winding down, which will ease some constraints creating very weak Waha gas prices. Looking ahead, KMI’s Permian Highway Pipeline has scheduled maintenance for the first two weeks of May, and that is expected to punish Waha prices again in a constrained market.

Infrastructure:

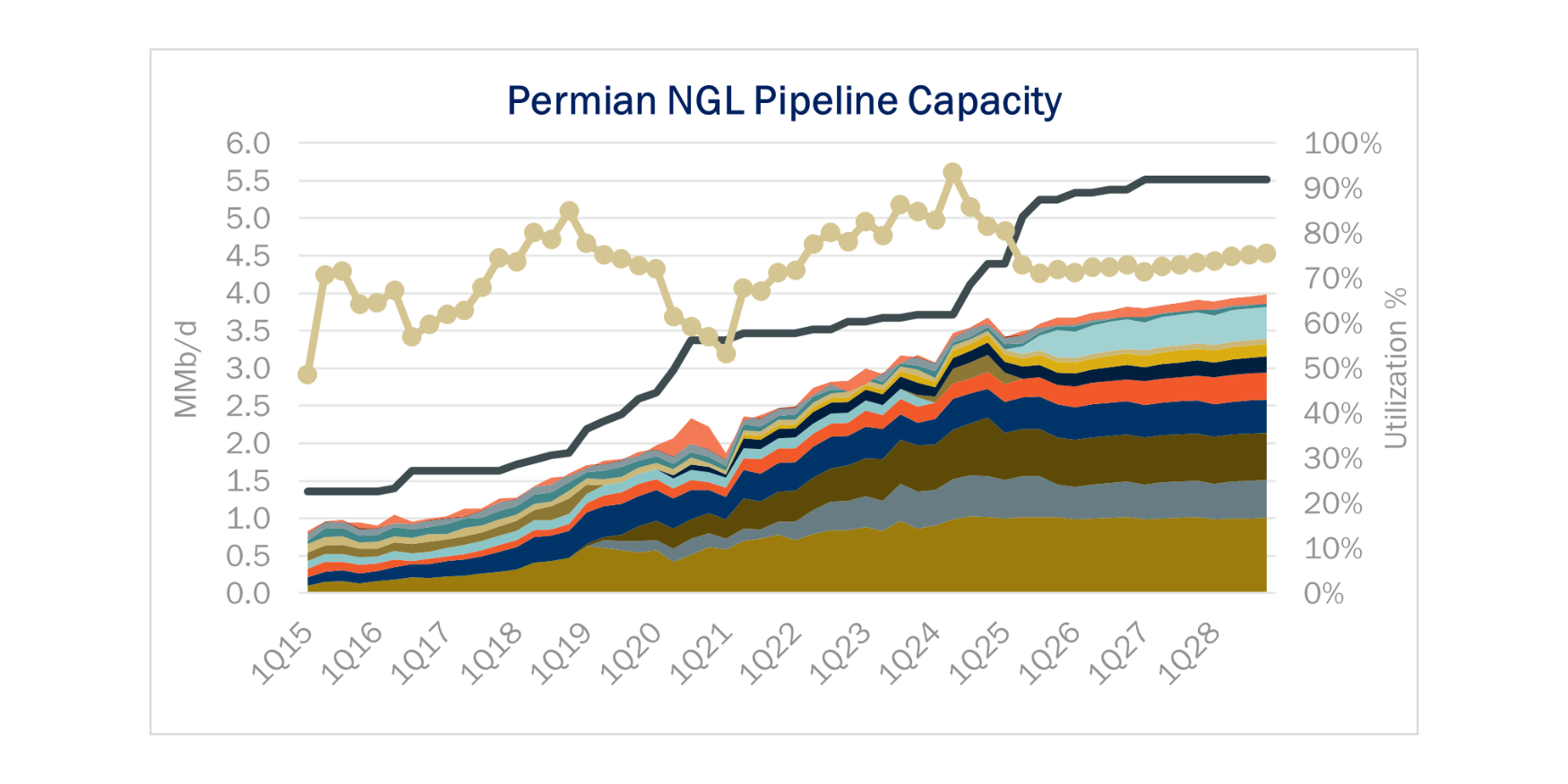

East Daley wrote about the earnings outlook for Targa Resources (TRGP) in an earlier note to clients, and the company met our expectations in strong 1Q24 results. The integrated Permian-levered NGL company is a good proxy for the Permian overall given that Targa processes about 25% of the gas molecules in the Midland and Delaware sub-basins.

Targa reported Permian plant inlet growth of 2% while NGL production was down 1% Q-o-Q. Targa’s new 275 MMc/d Greenwood plant went into service and filled quickly in the Midland Basin, but NGL volumes were down as we predicted due to the impact of Winter Storm Heather. The winter storm was good for Waha prices as supply dipped well below pipe egress capacity, but it was bad for ethane recovery (see figure). The EIA reported US ethane supply from processing plants declined by 9% from December ’23 to January ’24.

Purity Product Spotlight:

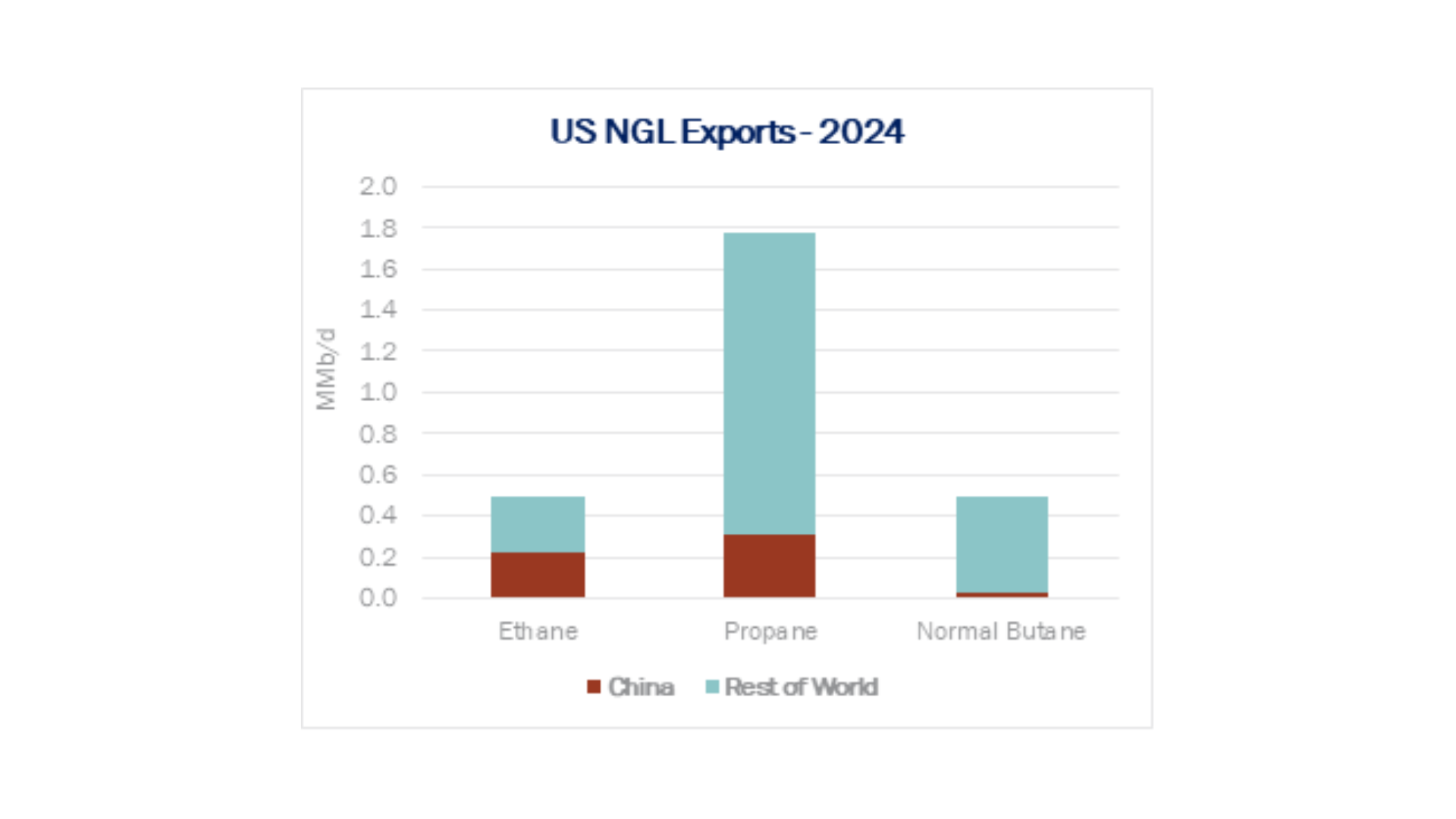

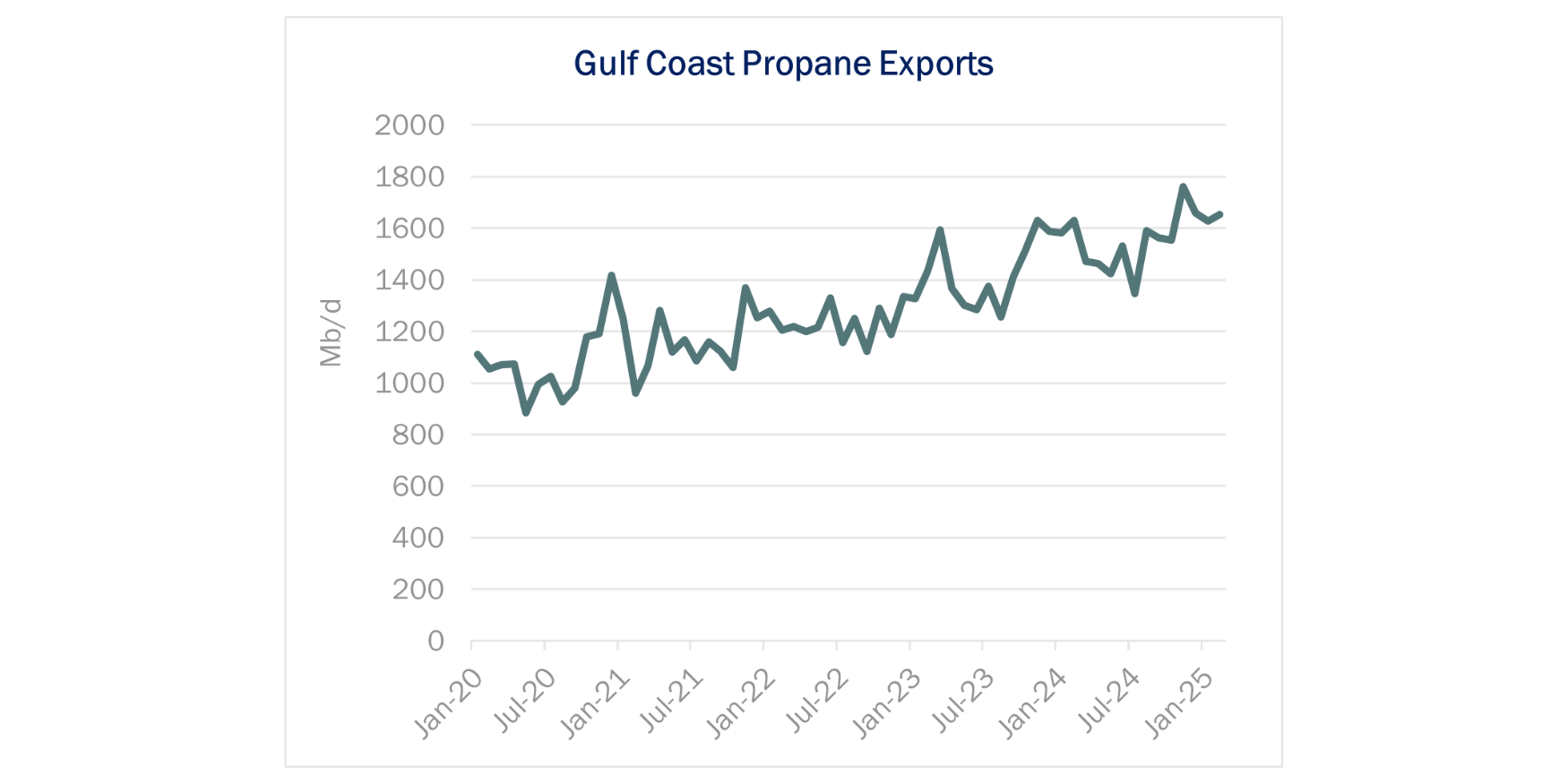

Sticking with Targa, the company managed to squeeze out a record 439 Mb/d of LPG exports from its Galena Park terminal in earnings posted Thursday morning (May 2). TRGP’s prior export record was 434 Mb/d in 4Q23.

Overall, LPG exports out of PADD 3 (Gulf Coast) were up nearly 10% from January to February ’24 to hit a daily record volume of 2,073 Mb/d. Antero Resources noted freight rates have improved dramatically, a helpful catalyst for spot LPG exports following a sluggish January. Higher domestic demand in the winter kept propane at home, as reflected in a narrowed spread from Mont Belvieu to the Far East (see figure).

-1.png)